How Does Bitcoin Mining Work? (Updated 2022)

What Is Bitcoin Mining?

Mining bitcoin is the process through the newly created bitcoins are introduced into circulation. It is also how the new transactions are verified by the network. It is an essential element of the development and maintenance of blockchain’s ledger. “Mining” is performed using sophisticated equipment that can solve an extremely complicated mathematical computation. The first computer that finds the solution gets with the following tranche of bitcoins. The process is repeated.

The process of cryptocurrency mining is arduous expensive, time-consuming, and rarely rewarding. However, it has attracted the attention of many investors who are interested in cryptocurrency due to it being a fact that miner get paid for their efforts with cryptocurrency tokens. It could be that people who are entrepreneurial believe that mining is a way to earn the equivalent of heaven’s pennies, as did California gold prospectors of 1849. If you’re technologically adept, why not take a shot at it?

However, prior to investing the time and resources go through this guide to find out if mining is the right choice appropriate for you. We’ll concentrate on Bitcoin (throughout the article, we’ll use “Bitcoin” when referring to the cryptocurrency or network as an idea or concept, and “bitcoin” when we’re referring to the number of tokens).

KEY TAKEAWAYS

- Through mining, you will earn cryptocurrency without needing to invest money in it.

- Bitcoin miners earn Bitcoin as rewards for the completion of “blocks” of verified transactions that are included in the Blockchain.

- Mining rewards are awarded to the person who finds an answer to a complicated hashing problem first. the likelihood that a miner is the one to solve the puzzle is related to the percentage of total mining power of the network.

- You will require either an GPU (graphics processing device) as well as an app-specific integrated circuit (ASIC) in order to setup mining equipment.

A New Gold Rush

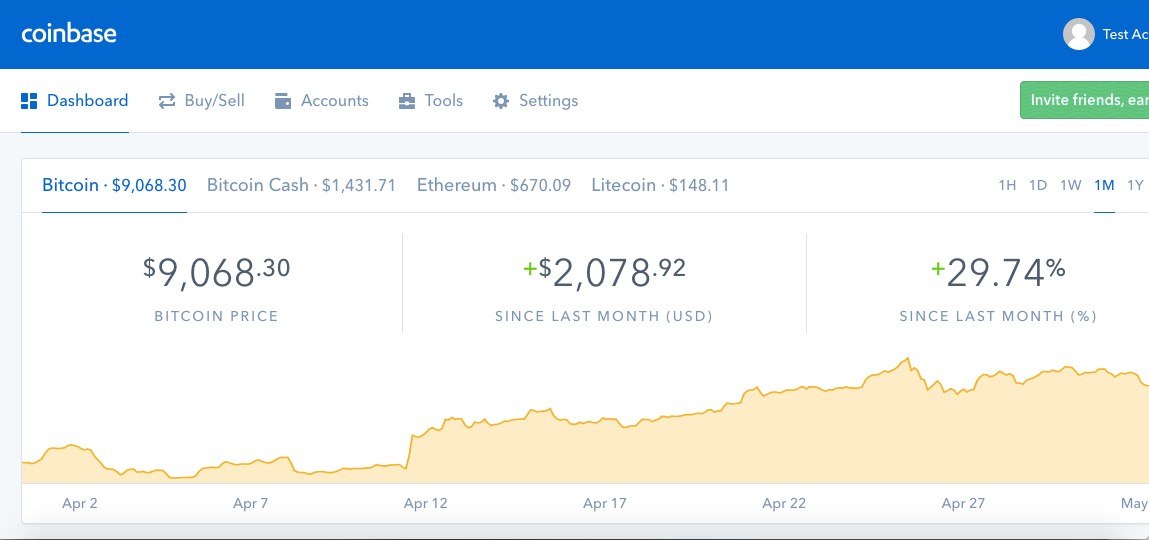

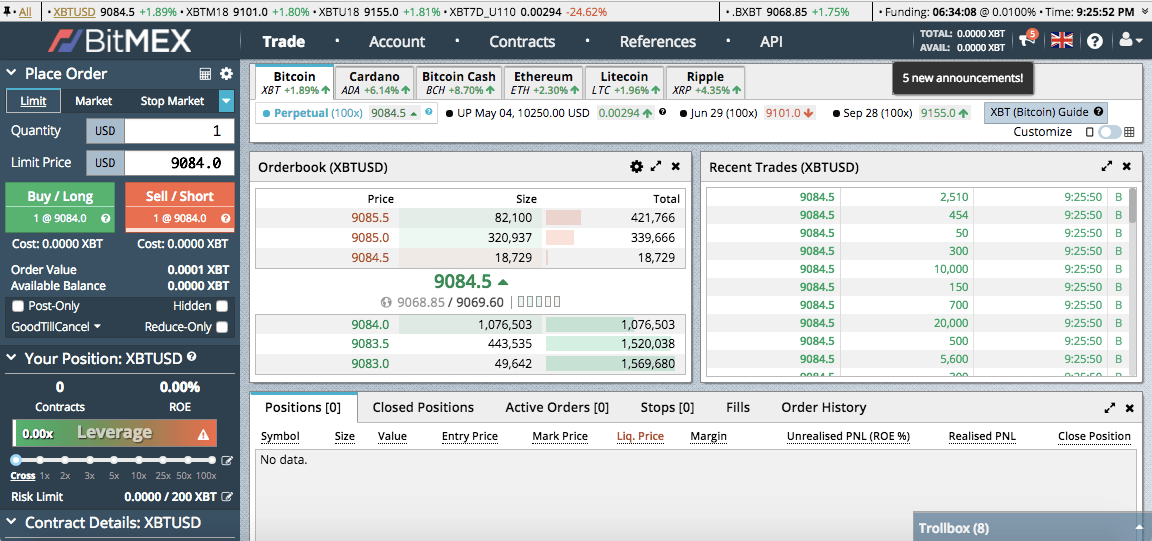

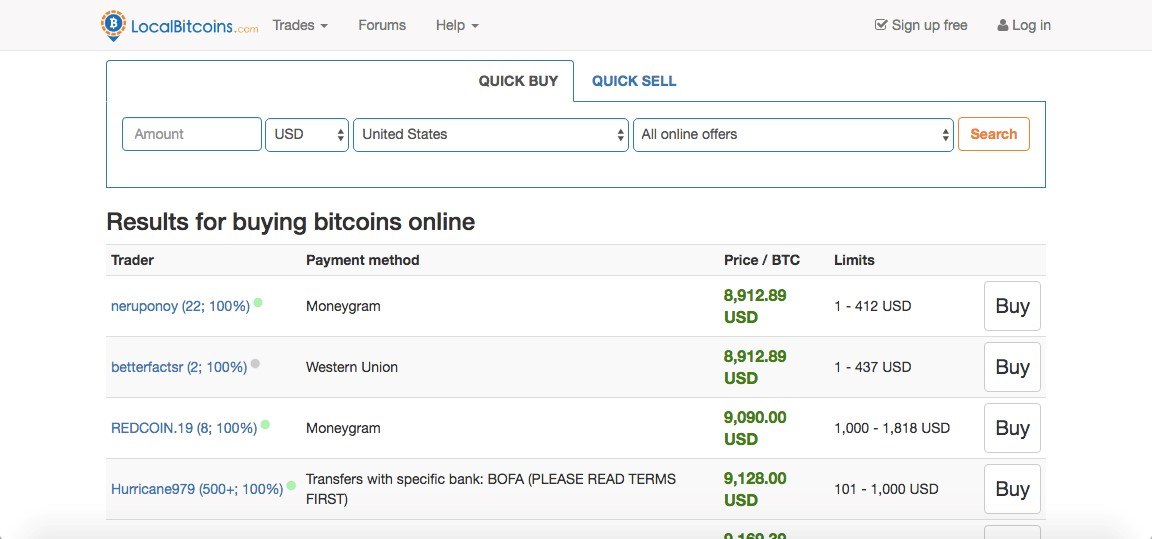

The most significant reason to consider mining companies is the possibility of earning Bitcoin. But, you do not need to be a mining entrepreneur to have cryptocurrency tokens. There is also the option to purchase cryptocurrencies with fiat currency or trade it in exchanges such as Bitstamp by using a different cryptocurrency (as as an instance, for instance, using Ethereum and NEO to purchase Bitcoin) and you earn it through buying, writing blog articles on platforms that pay their users in cryptocurrency, or establish an interest-earning cryptocurrency account.

One example of a crypto blogging service is Steemit that is sort like Medium however, users are able to pay bloggers for their work with an exclusive cryptocurrency known as SteEM. It can be then traded in exchange for Bitcoin.

The Bitcoin reward that miners earn is an incentive to encourage individuals to help in the primary goal of mining: to legitimate and oversee Bitcoin transactions, and ensure the validity of transactions. Since these responsibilities are distributed between a variety of users across the globe, Bitcoin is a “decentralized” cryptocurrency, which means one that does not depend upon any authority central to it, such as an institution like a central bank or government to regulate its operations.

Mining to Prevent Double Spend

Miners earn money for their services as auditors. They’re in charge to verify the authenticity and legitimacy of Bitcoin transactions. This is a way to ensure that Bitcoin users honest, and was designed by Bitcoin’s founder, Satoshi Nakamoto. 1 By the process of verifying transactions, miners can help to stop from the ” double-spending problem.”

Double spending can be described as a situation that occurs when an Bitcoin owner is able to spend on the exact same Bitcoin twice. When it comes to the physical money, it shouldn’t be an issue. If you give an individual a $20 bill to purchase a bottle of vodka, you don’t possess it, therefore there’s no risk that you’ll make use of that exact $20 to purchase lottery tickets the next door. While there is a possibility that counterfeit cash is made but it’s not like paying the same amount twice. However, with digital currency it is possible, as the Investopedia dictionary says, “there is a risk that the holder could make a copy of the digital token and send it to a merchant or another party while retaining the original.”

Let’s say you had a genuine $20 bill, and one counterfeit version of that same amount. If you tried to use both the genuine bill as well as the counterfeit anyone who took the time to examine both bills serial numbers would find that they had the same which means that one of them was likely to be fake. What is a Bitcoin mining company does is similar in that they verify transactions to ensure that no one has attempted to use the identical bitcoin twice. It’s not a perfect analogy, but we’ll discuss it in greater detail later.

One megabyte of transaction data could be contained in one bitcoin block. The 1MB limit was established by Satoshi Nakamoto. It is now a source of contention as some miners believe that the block size should be increased in order to accommodate more data. This could make it possible for the bitcoin network can process and verify transactions faster.

“So after all that work spent mining, I might still not get any bitcoin for it?”

It’s true. In order to earn Bitcoins you must in order to be one of the initial miner to find the correct answer, or the most appropriate answer, to a numerical problem. This process is also referred to in the field of the proof of work (PoW).

“What do you mean, ‘the right answer to a numeric problem’?”

A good thing is thatNo sophisticated math or computation is actually involved. There’s a chance that miners are solving complex math problems, but that’s not because math isn’t easy. What they’re really trying to do is be the first miners to create an hexadecimal 64-digit number (a ” hash”) that is smaller in comparison to or equivalent to desired hash. It’s basically speculation.

The downside:It’s a matter of the random or improbable However, given the amount of possible solutions for each one of these issues at the level of billions, this is extremely difficult task. The number of possible solutions is only increasing the number of miners are added to this mining system (known as mining difficulty). mining challenge). To tackle the problem miners require a significant amount in computing capacity. In order to be successful in mining you must have a very high “hash rate,” which is measured in terms of gigahashes each second (GH/s) and Terahashes per Second (TH/s).

If you’re looking to figure out how much bitcoin you can earn using your mining equipment’s hash rate, Cryptocompare provides a useful calculator. Other sites provide similar tools.

Mining and Bitcoin Circulation

Alongside filling mining pockets as well as helping to support in the Bitcoin community, it also also serves another important purpose: It is the only method to allow new cryptocurrency to enter circulation. Miners have the function of “minting” currency. As an example, in September 2021, there was about 18.82 million bitcoins available in the world, which is a number of around 21 million. 2

Apart from the coins created through the first block (the first block that was invented by the its founder Satoshi Nakamoto), every bitcoin was created because of miners. If miners were not present, Bitcoin as a network will still exist and remain accessible, but there’d never be any bitcoins. But, since the amount that bitcoin is “mined” is reduced over time, the last bitcoin will not be available until about 2140. It doesn’t mean transactions will no longer be checked. Mining miners are still required to validate transactions, and they will be compensated by fees in order to maintain an integrity to Bitcoin’s blockchain. 3

In addition to the immediate Bitcoin payout, being an active coin miner gives users “voting” power when changes are being considered in your Bitcoin blockchain protocol. This is referred to as a BIP (Bitcoin Improvement Protocol). Miners are able to influence over the process of decision-making regarding issues such like taking a fork.

How Much a Miner Earns

The benefits of Bitcoin mining decrease to half approximately each four months. 1 When bitcoin first began mining during 2009, mining a single block could earn an individual 50 BTC. In 2012, the amount was reduced down to just 25 BTC. In 2016, it was cut again in 2016 to 12.5 BTC. In May of 2020 the reward was reduced in value to 6.25 BTC.

In the month of September in 2021, the Bitcoin price was approximately $45,000 for a bitcoin. That means you’d earn $281,250 (6.25 times 45,000) when you completed the block. 4 Not an excellent incentive to tackle the complex hash issue described above, but it could be.

If you’d like to track the exact time when these halvings be happening, you can refer to the Bitcoin Clock, that updates the information in real-time. It is interesting to note that the value of Bitcoin has been, over the course of its history, generally correlated with the decrease in new coins that have released into circulation. The lower inflation rate has increased the scarcity of Bitcoin, and in the past, its price has increased with it.

If you’re curious about the number of blocks that have been mined to date There are several websites like Blockchain.info, that can provide you with this info in real-time.

What You Need to Mine Bitcoins

Though in the beginning of Bitcoin’s history , individuals might be able to be competitive for blocks using an ordinary personal computer at home however this is no longer the situation. The reason is that the difficulty in mining Bitcoin alters with time.

To ensure the efficient functioning of the blockchain as well as its capability to verify and process transactions to ensure its integrity, the Bitcoin network strives to produce one block at every one minute or more. But, if there’s millions of mining rigs competing to solve the problem of hash and come to the solution quicker than the situation where only more than 10 mining equipments are engaged in the same task. This is why Bitcoin was designed to assess and alter the mining difficulty every 216 blocks, which is roughly each two weeks. 1

If there’s more computing power that is collectively used to mine bitcoins, the difficulty of mining grows to ensure the production of bitcoins at a constant level. A lower computing capacity means that the difficulty level is reduced. With the current size of the network an individual computer mining bitcoins will probably not find anything.

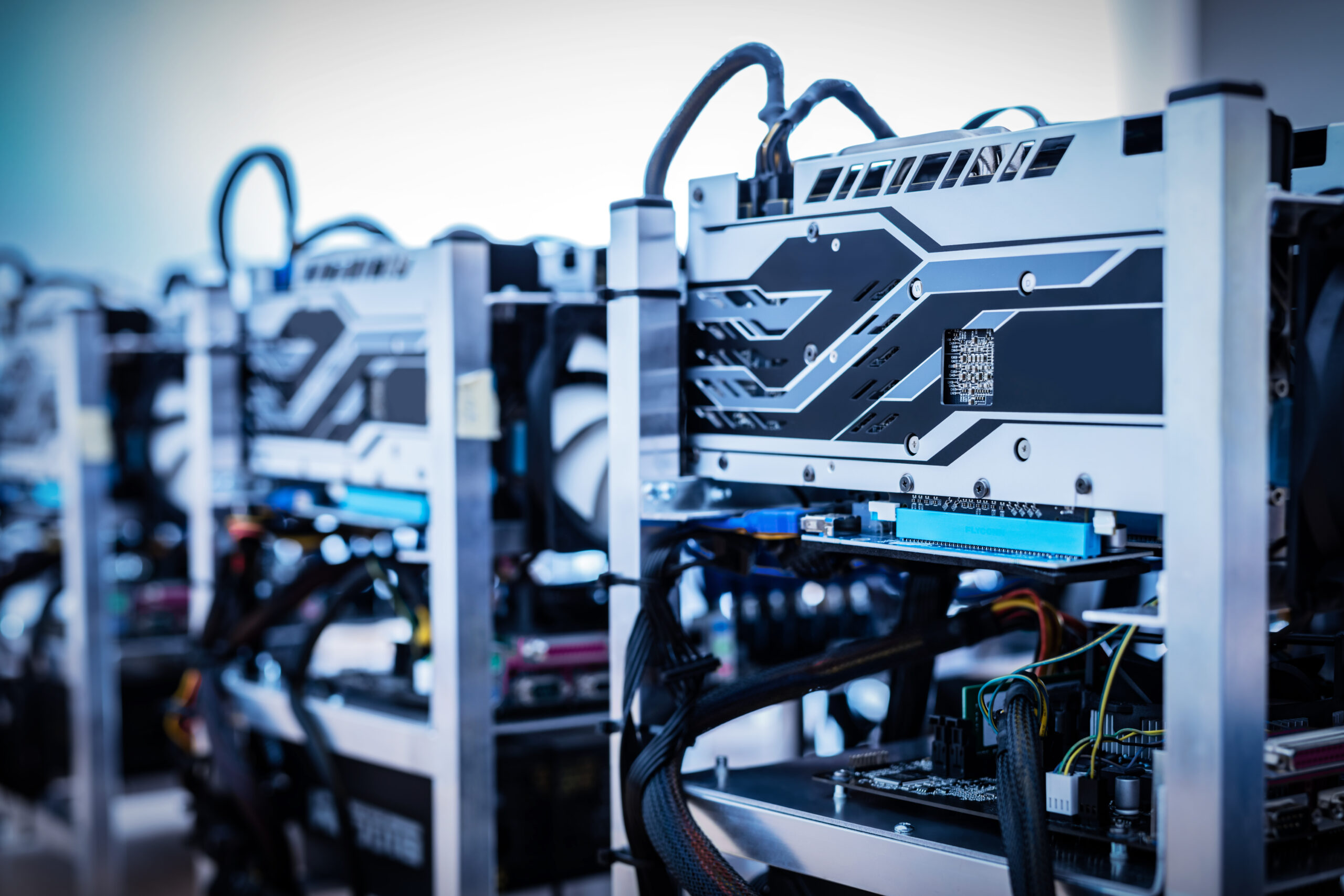

All of this means that, to be competitive in mining miners have to invest in powerful computing equipment, such as GPU (graphics processing unit) or, more accurately the application-specific integrated circuit (ASIC). These range between $500 and hundreds of thousands. Some miners — particularly Ethereum miners — purchase specific graphics card (GPUs) to provide a cheap method of combining mining activities.

An Analogy

Imagine telling three people that I’m contemplating a number between one and 100. I write it down on one of the pieces of paper, and then seal it up inside an envelope. My buddies don’t have to know the exact number. They simply have to be the first person to guess a number that is lower than or equivalent to the number that I’m thinking of. And there’s no limit on the number of guesses they can make.

Let’s say I’m thinking about 19, for example. If Friend A guesses 21 and loses because 21 is greater than 19. If Friend B is guessing 16 and C guesses 16, and C thinks 12 they’ve theoretically arrived at plausible answers because 16 19 and 12 19. There’s there is no “extra credit” for Friend B even the fact that B’s answer was more close to the desired answer of 19. Now imagine I ask you with the “guess what number I’m thinking of” question, however I’m not asking only three people but I’m thinking of a number that is between 1 to 100. Instead, I’m posing millions of potential miners to answer as I’m that thinking about a 64-digit hexadecimal hexadecimal. You can see that it’s going to be incredibly difficult to determine the correct answer.

If B and C respond at the same time, the analogy is broken.

In Bitcoin terms the frequency of simultaneous answers is high however, in the final analysis, there could only be one winning solution. If multiple simultaneous answers are given that are equal to but less than desired number and it is the Bitcoin network will determine by a simple majority, namely 51%, which mining company will honor.

Typically, it’s the miner who has performed the most work, or that is the one who validates the largest number of transactions. The lost block is then an ” orphan block.” Orphan blocks are ones which aren’t being added to blockchain. Miners who have solved the hash issue but aren’t able to verify the majority of transactions don’t get bitcoin.

What Is a “64-Digit Hexadecimal Number”?

Here’s an example this number:

0000000000000000057fcc708cf0130d95e27c5819203e9f967ac56e4df598ee

The above number has 64 numbers. It is easy enough to comprehend at this point. You may have noticed this number does not consist only in numbers. It also includes the letters that make up the alphabet. What is the reason for this?

To better understand the function of these letters within the numbers, let’s break down the term “hexadecimal.”

The decimal system employs as its basis factors 100 (e.g. that 1 percent equals 0.01). This implies that every digit in the multi-digit number is capable of 100 possibilities, ranging from zero to ninety-nine. In computing the decimal system, it is reduced to base 10, which is zero to nine.

“Hexadecimal,” on the contrary, refers to base 16 as “hex” is derived from the Greek word meaning six, as well as “deca” is derived from the Greek word meaning 10. In a hexadecimal format every digit offers sixteen possibilities. The numeric system however only provides 10 different ways to represent the numbers (zero to nine). This is why you need to insert letters specific letters, such as A, B, C and d, as well as e and the letter f.

If you’re mining Bitcoin it is not necessary to have to determine the total value of this 64-digit code (the hash). In other words, you don’t need to determine the value of the hash.